AI Compounding: Why Winners Accelerate & Losers Get Left Behind

📈 The Compound Effect: Why AI Winners Reinvest While Losers Retreat

Three years into the AI era, a troubling pattern has emerged. While 96% of organizations report productivity gains from AI, the gap between leaders and laggards isn't just widening—it's accelerating through a self-reinforcing loop that's proving nearly impossible to break.

The data reveals an uncomfortable truth: AI advantage compounds. Organizations that invest early see returns, reinvest those returns into deeper capabilities, and pull further ahead. Meanwhile, those still experimenting find themselves not just behind, but falling further back every quarter. The window to catch up is closing faster than most executives realize.

This isn't about having better tools or bigger budgets. It's about organizational momentum—and the brutal mathematics of compounding returns.

Let's dive in.

⚡️ The Flywheel That Can't Be Stopped

The most successful AI deployments aren't following a linear path. They're following an exponential one.

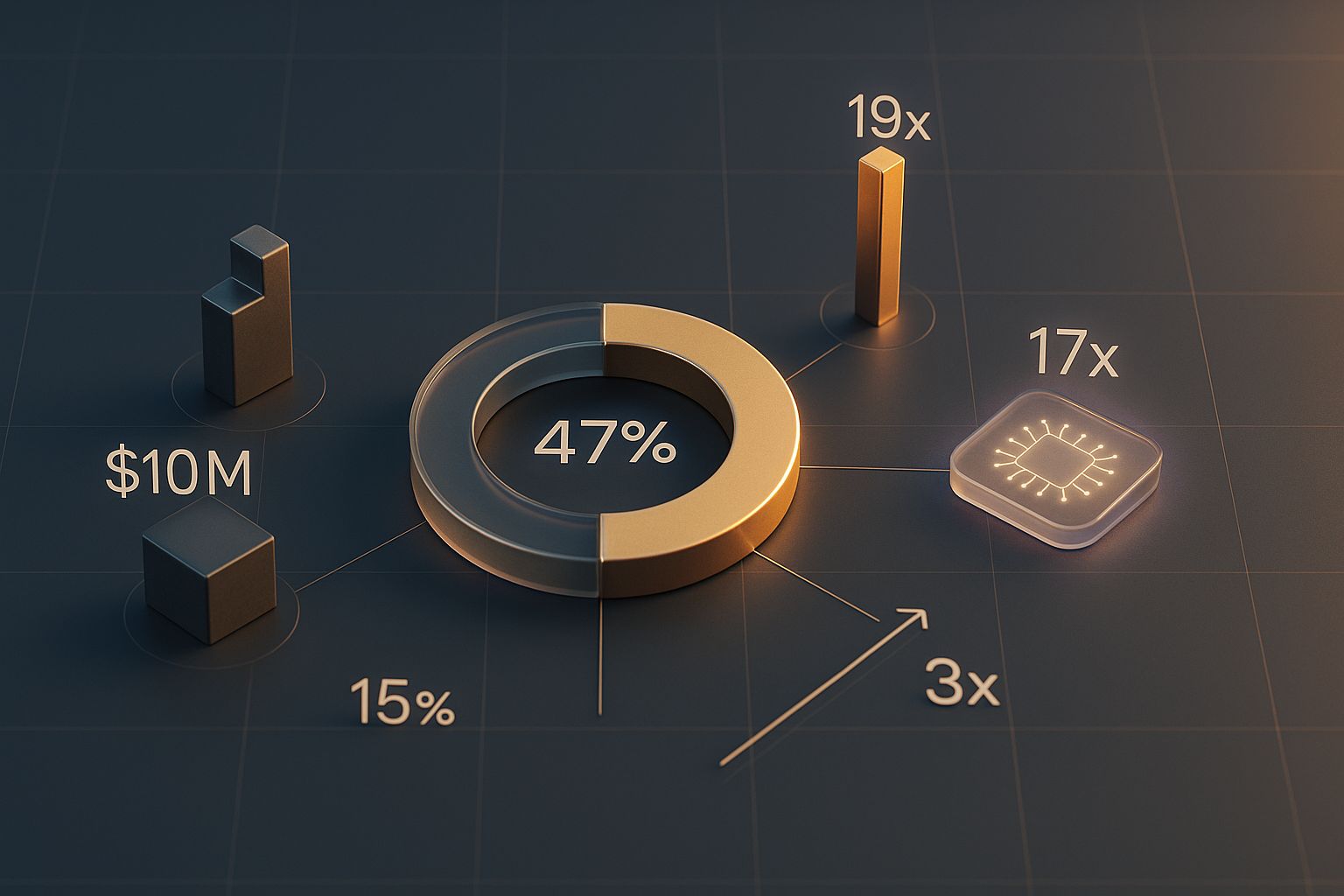

According to a comprehensive EY survey of 500 senior leaders, 96% of organizations are seeing measurable AI-driven productivity gains. But here's what separates winners from everyone else: 96% of those seeing gains are immediately reinvesting them. Leaders are plowing 47% of their productivity savings back into expanding AI capabilities, while another 42% funds entirely new AI initiatives.

This creates a flywheel effect. Time saved funds more AI investment. More investment enables more sophisticated use cases. More sophisticated uses generate bigger returns. Those returns fund infrastructure that enables capabilities competitors simply can't replicate.

The data from NTT DATA's 2026 Global AI Report quantifies exactly how dramatic this gap has become. Only 15% of organizations qualify as "AI leaders"—but these leaders achieve 2.5x higher revenue growth and 3x higher profit margins than their peers. They're not incrementally better. They're operating in a different performance tier entirely.

The Usage Gap Reveals Everything

OpenAI's enterprise data shows how this advantage manifests in daily work. "Frontier workers"—those in the 95th percentile of AI adoption intensity—generate six times as many AI interactions as median workers. But the gap explodes when you look at complex tasks: these users are 10 times more active in analysis and calculations, and 17 times more active in coding.

This isn't about enthusiasm. It's about infrastructure. As Nathan Labenz noted on the Cognitive Revolution podcast, organizations that succeed are building custom workflows, deploying specialized agents, and creating environments where AI becomes embedded in how work actually happens. The usage gap reflects an infrastructure gap—and infrastructure takes time and investment to build.

Weekly usage of custom GPTs and projects in enterprise environments jumped 19-fold this year, according to OpenAI's research. Organizations aren't just chatting more—they're fundamentally restructuring how knowledge work gets done. Each custom GPT represents captured context, refined prompts, and organizational knowledge that compounds in value with every use.

Why More Use Creates More Value (Non-Linearly)

The returns from AI usage aren't linear—they're exponential. OpenAI found that workers who save over 10 hours weekly use about eight times as much AI as those reporting zero hours saved. More critically, workers engaging across seven different task types report five times as much time savings as those using AI for just four task types.

Bain's analysis of enterprise AI infrastructure reveals why: shallow integration delivers shallow returns. Organizations achieving real ROI are redesigning workflows around AI capabilities, not just adding AI to existing processes. They're building what Bain calls "the new AI stack"—infrastructure purpose-built for AI-native operations.

The evidence shows up across industries. McKinsey's research on corporate credit processes found that agentic AI systems deliver 40-80% productivity uplifts when deployed end-to-end. Deutsche Bank cut credit decision cycles by 50% through comprehensive AI integration. But these results require reimagining the entire process, not just automating pieces of it.

The Investment Acceleration

Organizations spending $10 million or more on AI are seeing fundamentally different outcomes than smaller spenders. According to the EY survey, 71% of large spenders report significant productivity gains, compared to just 52% of those investing under $10 million. The gap suggests there's a minimum threshold of investment required to build the infrastructure that enables real transformation.

And leaders aren't taking these gains as profit. They're buying more AI.

Leaders are reinvesting 47% of productivity gains back into AI capabilities, creating a compounding loop that makes them increasingly difficult to catch. Only 17% are reducing headcount, and just 24% are returning capital to stakeholders. The message is clear: AI winners view productivity gains as fuel for further investment, not cost savings to be extracted.

This reinvestment pattern appears in multiple data sources. Organizations are using initial wins to justify deeper commitments—building data infrastructure, hiring specialized talent, and deploying increasingly sophisticated systems that smaller competitors can't match.

Bottom Line: The gap between AI leaders and laggards isn't stabilizing—it's accelerating. Organizations that generated early wins are reinvesting those gains into capabilities that widen their advantage every quarter. For those still experimenting, catching up requires not just matching current investments, but overcoming the compounded advantage leaders have already built.

🏭 AI Across Industries

💳 Financial Services: The 40-80% Productivity Leap

McKinsey's analysis of agentic AI in corporate credit demonstrates how leaders are pulling ahead through systematic implementation. End-to-end deployment of AI agents across credit origination, monitoring, and decisioning delivers 40-80% productivity improvements—but only when organizations redesign workflows rather than automate existing ones.

The key insight: partial deployment delivers partial results. Oliver Wyman's research on active AI transformation in banking found that leaders are moving beyond isolated use cases to enterprise-wide transformation—building "agentic twins" that mirror entire business processes and enable continuous optimization.

📌 Takeaway: Financial services leaders are treating AI as architectural—rebuilding core processes around AI capabilities rather than adding AI to legacy workflows. The investment required explains why only top performers can maintain the pace.

🏥 Healthcare: Redefining ROI Beyond Financial Metrics

Healthcare organizations are discovering that traditional ROI frameworks miss AI's real value. Premier's new framework for healthcare AI argues that clinical impact—improved patient outcomes, reduced adverse events, earlier interventions—should drive deployment decisions, with financial returns as a secondary consideration.

This shift reflects maturity. Early adopters chased cost savings; leaders optimize for patient care. Evalueserve's research on life sciences transformation found that organizations treating AI as foundational infrastructure—rather than experimental technology—are seeing $1-2 million in annual value per 100-bed hospital through applications like sepsis detection and care coordination.

📌 Takeaway: Healthcare leaders are building four-dimensional ROI models (clinical, operational, ethical, financial) that justify deeper investment in AI infrastructure. This comprehensive approach enables sustained competitive advantage through better patient outcomes and operational excellence.

🏭 Manufacturing: From Automation to Strategic Intelligence

Manufacturing AI has evolved beyond simple automation. TMA Solutions' analysis shows leaders deploying AI agents for strategic decisions—demand forecasting, supply chain optimization, product development—rather than just production efficiency.

The pattern mirrors broader trends: superficial automation delivers modest gains, while strategic integration transforms business models. Manufacturing leaders are building AI capabilities that compound over time—each optimization improving data quality for future decisions, each insight refining predictive models.

📌 Takeaway: Manufacturing leaders are moving AI from the factory floor to the C-suite, using it for strategic decisions that create compounding competitive advantages. Investment in AI infrastructure becomes investment in strategic capability.

🛡️ Insurance: The 70-80% Automation Threshold

KPMG's research on insurance digitization reveals that leading insurers are offloading 70-80% of claims preparation work to AI agents. But these results required substantial upfront investment in data infrastructure, process redesign, and governance frameworks.

The advantage compounds. Organizations that invested early now have refined models, optimized workflows, and institutional knowledge about what works—advantages that can't be quickly replicated. As HBR's recent IdeaCast on organizational transformation noted, leaders are moving from "factory model" hierarchies to distributed intelligence networks where AI enables frontline decision-making.

📌 Takeaway: Insurance leaders are building AI infrastructure that enables autonomous claims processing at scale. The investment and learning required creates natural barriers to entry that widen their competitive moat.

📈 AI by the Numbers

📊 47% reinvestment rate — Organizations seeing AI productivity gains reinvest nearly half those savings back into expanding AI capabilities, according to EY's survey of 500 senior leaders. Only 17% are reducing headcount, while 24% return capital to stakeholders. The message: leaders view AI gains as fuel for acceleration, not cost savings to extract. (EY Global AI Survey 2025)

🚀 19x growth in custom AI deployments — Enterprise usage of custom GPTs and specialized AI projects exploded 19-fold in 2025, OpenAI reported. This shift from generic chatbots to purpose-built agents represents fundamental workflow transformation. Each custom deployment captures organizational knowledge and context that compounds in value with every use. (OpenAI State of Enterprise AI 2025)

💰 $10M investment threshold — Organizations investing at least $10 million in AI report "significant productivity gains" at 71% rates versus 52% for smaller spenders, per the EY survey. The gap suggests minimum infrastructure investments required to achieve transformation rather than incremental improvement. Leaders are crossing this threshold while laggards debate ROI. (EY Global AI Survey 2025)

⚡ 17x activity gap in coding — "Frontier workers" in the 95th percentile of AI adoption generate 17 times as many coding-related messages as median workers, according to OpenAI's enterprise data. As Nathaniel Whittemore noted on The AI Daily Brief, this gap reflects infrastructure sophistication—leaders have built environments where AI coding assistance is embedded in developer workflows, not just available as an option. (OpenAI Enterprise Research 2025)

🎯 2.5x revenue growth differential — NTT DATA's global research found AI leaders achieve 2.5 times higher revenue growth and 3 times higher profit margins than peers. Only 15% of organizations qualify as leaders, but they're pulling away exponentially. The performance gap isn't linear—it's compounding quarterly as leaders reinvest gains while laggards remain stuck in pilot purgatory.

📰 Five Headlines You Need to Know

🏢 IBM and Pearson Launch AI-Powered Learning Platform — The partnership addresses a $1.1 trillion global skills mismatch by deploying AI tutors and adaptive learning systems. The significance: leaders are building workforce AI capabilities that compound—each employee upskilled becomes more productive, generating returns that fund further training investment.

🔐 AI Governance Becomes Growth Enabler, Not Compliance Cost — Credo AI's 2026 playbook reveals that organizations treating governance as strategic infrastructure deploy AI faster and more broadly than those viewing it as overhead. Strong governance frameworks enable confident scaling—a compounding advantage as regulatory scrutiny intensifies.

📊 95% of AI Pilots Still Failing to Reach Production — Despite three years of experimentation, most AI initiatives never escape pilot purgatory. The 5% that do? They've built infrastructure, governance, and organizational capabilities that enable systematic scaling. The gap between pilots and production isn't technical—it's organizational.

🏗️ NextGen Reveals 30-60% Productivity Gains, 6-12 Month Payback — Analysis of agentic AI deployments shows leaders achieving substantial productivity improvements with rapid payback periods. But results require end-to-end process redesign and infrastructure investment—explaining why gains compound for those who commit while tentative adopters see minimal impact.

🎙️ Voice AI Hits $300M ARR as ElevenLabs Scales Enterprise — As discussed on the No Priors podcast with ElevenLabs co-founder Mati Staniszewski, enterprise voice AI is moving beyond novelty to production deployment. Processing 25 trillion tokens monthly, ElevenLabs demonstrates how specialized AI capabilities compound—each implementation refines models, each customer success enables deeper penetration.

🎯 The Final Take: The Path Forward

The data reveals an uncomfortable truth about AI transformation: advantage compounds, disadvantage multiplies, and the gap between leaders and laggards grows exponentially rather than linearly.

Organizations seeing early AI wins are reinvesting nearly half those gains back into capabilities—custom infrastructure, specialized agents, enterprise-wide integration. Each investment enables more sophisticated uses. More sophisticated uses generate bigger returns. Bigger returns fund infrastructure that competitors can't match. The flywheel spins faster every quarter.

Meanwhile, those stuck in pilot purgatory face a different dynamic. Each delayed decision allows competitors to build advantages that become harder to overcome. The 95% pilot failure rate isn't random—it reflects organizations treating AI as a technology problem rather than an infrastructure investment. They're optimizing for quick wins instead of compounding capabilities.

The choice isn't whether to invest in AI. That decision has been made. The question is whether to invest enough to build infrastructure that enables compounding returns—or to remain trapped in a cycle of experiments that deliver incremental gains while competitors pull exponentially ahead.

The window is closing. Not because AI is going away, but because the leaders building AI-native infrastructure are creating moats that become more defensible with every passing quarter.

Until next week!

🎯 Ready to build AI transformation capacity at your organization? Velocity Road helps mid-market companies move from experimentation to scaled deployment through strategic planning, workforce readiness, and change management:

Schedule a consultation today.

📬 Forward this newsletter to colleagues who need to understand AI's production reality. And if you're not subscribed yet, join thousands of executives getting weekly intelligence on AI's business impact.